Is Your Data Telling You It’s Time for Changes to Your Supply Chain?

It is human nature to resist change. In my role as a supply chain consultant, I encounter this resistance often. When changes to a company’s supply chain are proposed, it’s common for leaders to respond with comments and questions such as: “the supply chain isn’t broken, there’s no need to change anything,” “we can’t disrupt the business” or “more is always better, right?”Then, I am frequently in a position where I need to challenge those statements.

- “The supply chain isn’t broken, there’s no need to change anything.” It might not be broken, but it can be optimized.

- “We can’t disrupt the business.” Change may feel disruptive, but it can be positive.

- “More is always better, right?” No. (And I’ll dig into why in this article.)

The fact of that matter is that your supply chain could be doing you more harm than good if you’re not open to change. It is also critical to ask the right questions of your managed service provider (MSP) to determine the proper course of change for your supply chain. Being open-minded to the story your performance data can tell, in terms of forecasting best practices for the future, is also helpful.

How Data Can Assess the State of Your Supply Chain

Let’s take a look at the case of a large technology client with several lines of business supported by an oversaturated supply chain. Over the course of two years, supplier performance data was presented to demonstrate the critical need to reduce the number of suppliers supporting the program. The recommendations to remove underperforming suppliers were dismissed. Long-standing relationships between suppliers and hiring managers were an obstacle. The supply chain wasn’t overtly broken in the eyes of the client. And the “more is better” mentality among stakeholders also played a role.

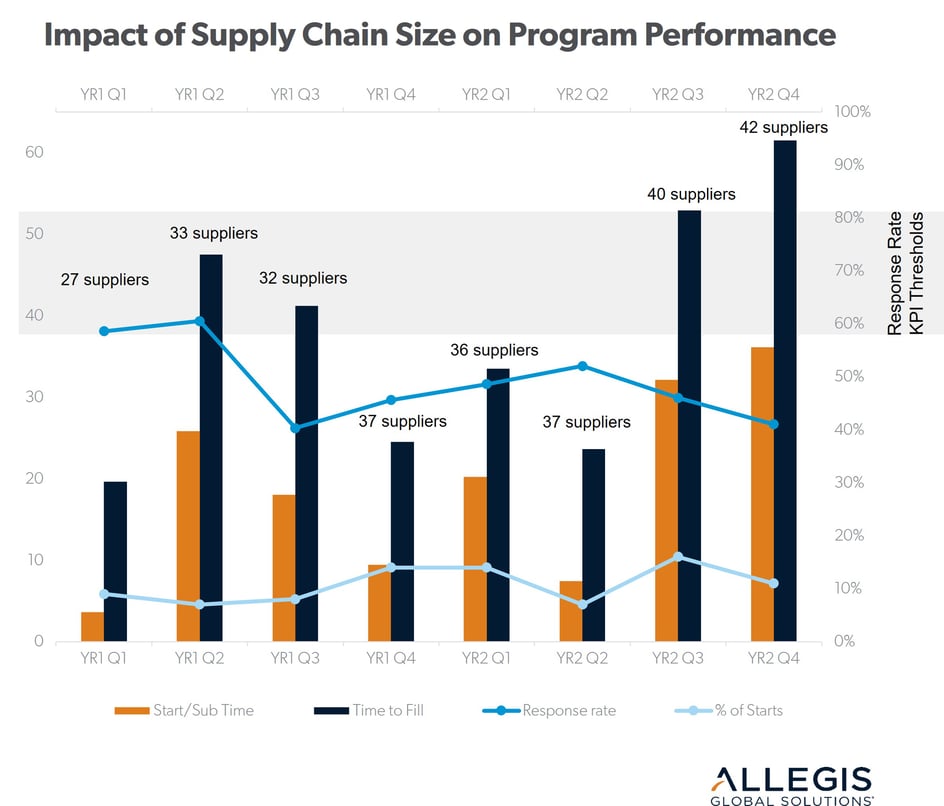

Admittedly, the supply chain wasn’t broken. However, there were several deficiencies that were impacting overall supplier engagement and, ultimately, the client’s goal of procuring top talent efficiently and effectively. To present the most compelling case to optimize the client’s supply chain, AGS juxtaposed crucial performance metrics over the course of eight quarters for key labor categories. The goal was to give the data a stronger impact through an easily digestible visual presentation.

The story for the labor category in the above graph was easy to tell. Within this labor category, there was an average of 36 suppliers sourcing for approximately 10-12 requisitions per quarter. The key data points are summed up as follows:

- Start submittal time and time to fill – as indicated by the bars on the graph – increased over the two-year timespan as the number of suppliers receiving each requisition increased. Start submittal time is the amount of time it takes for the right candidate to be submitted – in other words, how long the recruitment process takes to find the winning candidate. Time to fill measures the amount of time from the release of the requisition to suppliers, to offer acceptance and start by the winning candidate. Simply put, it was taking more time for suppliers to source and submit the right candidate and, ultimately, for the client to onboard talent.

- As more suppliers received the requisition, the average response rate decreased. Suppliers were becoming less engaged in the program as the amount of competition increased. As job requirements were being released, suppliers were not prioritizing them.

- Historically, this program was not meeting client expectations for this key performance indicator (KPI). As a result of requisitions being released to additional suppliers, the average supplier response rate was below the threshold for the KPI.

- Even though requisitions were distributed to a high number of suppliers, the percentage of competitive starts was low. This data demonstrates that opportunities were not being equally distributed to all suppliers. Factors such as preexisting relationships between hiring managers and suppliers were impacting healthy competition among all suppliers supporting the business.

Impacts of an Oversaturated Supply Chain

A bloated supply chain was impacting many aspects of the client’s program. Supplier engagement was low. For almost every quarter analyzed, supplier response rates were well below the expectations of AGS and the client. This, in turn, impacted how long it took to identify, submit and hire candidates for assignments.

Suppliers simply weren’t prioritizing the job requirements released to them by this client. When a supplier knows they have such a large contingent of competitors for your business they may ask themselves:

- Why assign top recruiters to a job requirement with a sense of urgency when I know there are more than 30 other suppliers receiving the same opportunity?

- Why focus on selling the client brand/opportunity to candidates?

- Why provide competitive pricing to the client when market share is minimal?

Embracing Supply Chain Changes Can Lead to Program Improvements

The negative impact on operational efficiencies and overall success of the program was now more evident to the client. Once the key client stakeholders were on board with AGS’ recommendations to significantly reduce the number of suppliers supporting the program, we returned to the individual and comparative supplier performance data, which identified those suppliers who did not meet program expectations.

Moving forward, the client has approved removing several suppliers from the program and – in partnership with AGS – has established a methodology to ensure stronger performance in key metrics such as speed, quality and cost. Though it took time, significant dialogue and a different way of looking at the data, the client has recognized the inefficiencies and embraced change.

Taking an Active Approach to Supply Chain Management

A high-performing workforce supply chain doesn’t happen overnight. The journey requires a continuous commitment to maintaining open communication and maximizing performance. By engaging an MSP with wide-ranging experience in driving supplier relationships, an organization can reap the benefits of a partner that will respond quickly, deliver quality results and support a cost-effective strategy.

Great supply chain management means better access to the right resources to get the work done – at the right time and cost. Lasting impact requires strong relationships and a managed service provider (MSP) structure that gives suppliers the best opportunity to achieve long-term success. AGS serves as a consultative partner to our clients seeking top talent, and we are responsible for driving change to the supply chain when necessary.

-min.png)